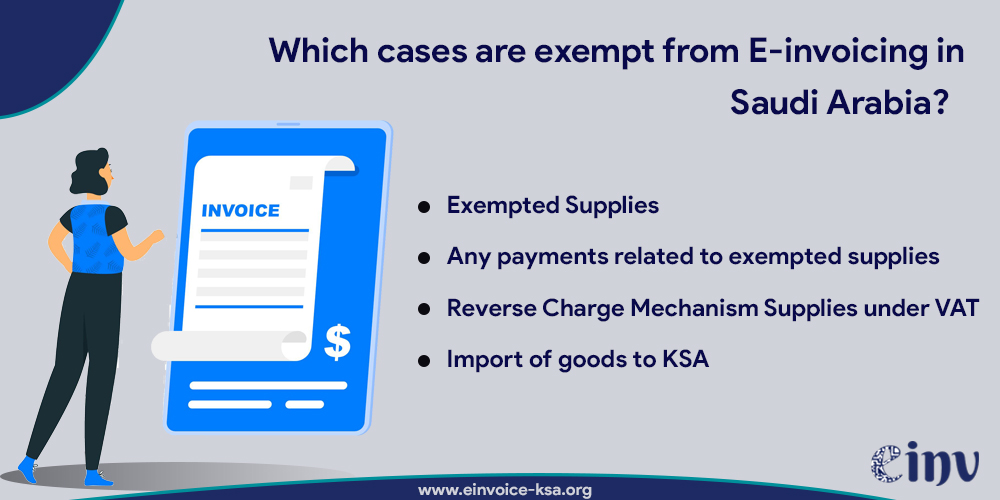

Few transactions are exempted under SA e-invoicing. This Blogs lists downs the transactions for which you don’t have to generate e-invoices or related Credit Debit Notes (CDNs).

1.Exempted Supplies

Certain domestic transactions, such as financial services or residential property rentals, are VAT exempt in Saudi Arabia. Hence, there's no need to issue e-invoices or related CDNs for these transactions.

2. Any payments related to exempted supplies

ZATCA exempted the below transactions from SA e-invoicing:

· payments related to exempted supplies

· Amount received for making exempted supplies

3. Reverse Charge Mechanism Supplies under VAT

Under SA VAT, for services from non-residents, VAT is charged via the Reverse Charge Mechanism. Non-residents don't issue e-invoices or CDNs, and recipients don't need to generate e-invoices but must keep transaction records for VAT reporting.

4. Import of goods to KSA

For imported goods in Saudi Arabia, VAT is paid through Customs during clearance. Since there's no separate supply within KSA, neither the supplier nor the importer needs to issue e-invoices or related CDNs for these transactions.

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.