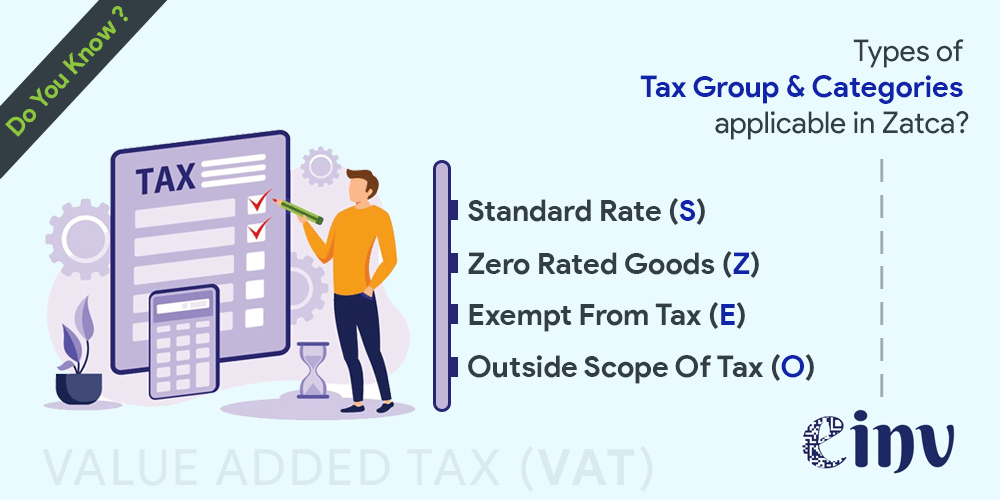

Tax Group : Below is the Tax Group scheme 5305 table for your reference:

Standard Rate: The standard VAT rate (”ضريبة القيمة المضافة”) in the Kingdom of Saudi Arabia (KSA) is 5%, 15%. Some services, such as certain financial services, are exempt from Saudi Arabian VAT. It Applies to all taxable supplies, with certain exceptions.

Zero Rated Goods: Exported goods, services supplied to non-GCC* residents, international passengers, goods transportation services, supply of qualifying means of transport, medicines, qualifying medical equipment, and supplies of investment metals are, amongst others, zero-rated supplies.

Exempt From Tax: "Exempt from tax" means that certain goods, services, or transactions are not subject to paying Value Added Tax (VAT) or other taxes. This could include things like basic necessities such as food, healthcare, and education, as well as some financial services, government services, exports, and certain real estate transactions. Basically, it means that these items or services are not taxed when bought or sold in Saudi Arabia.

Service Outside Scope of Tax: ‘Services outside the scope of tax' means that certain services are not subject to paying taxes like Value Added Tax (VAT). This means when these services are provided or received, there's no tax added to their cost.

When opting for a non-standard tax rate, it is essential to clearly state the associated terms.

1) Exemption reason - This refers to the justification for why a particular supply is exempt from VAT. ZATCA defines various exemption reasons in their regulations, each with specific criteria that must be met for the exemption to apply.

2) Exemption Codes - ZATCA assigns specific codes to each exemption reason for reporting purposes. These codes are used in e-invoices and VAT returns to identify the nature of the exemption applied. Each code corresponds to a specific exemption reason defined in the regulations.

Tax Category : Below is the tax category scheme 5153 table for your reference.

Meet Jadav, an experienced Marketing & Finance professional with a passion for digital transformation. With a background in accounting and technology, He specializes in e-invoicing solutions and writes insightful blogs to educate businesses on the benefits and best practices of adopting electronic invoicing. He is dedicated to simplifying complex financial processes for organizations.

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.