Phase 1, known as the Generation phase

will require taxpayers to generate and store tax invoices and notes through electronic solutions compliant with Phase 1 requirements.

Phase 1 is enforceable as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT.

Phase 2 (enforceable starting January 1st, 2023, in waves)

Phase 2, known as the Integration phase and rolled-out in waves by targeted taxpayer groups, will involve the introduction of Phase 2 technical and business requirements for electronic invoices and electronic solutions, and the integration of these electronic solutions with ZATCA’s systems.

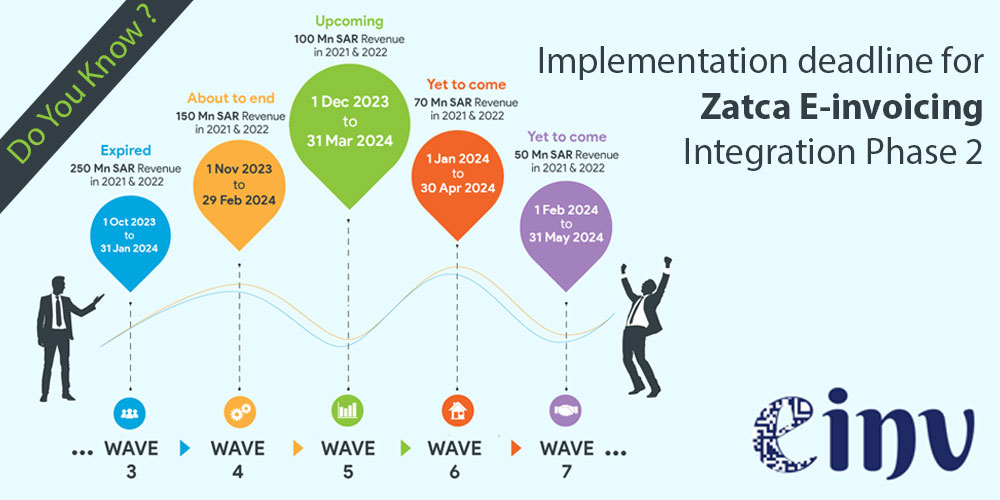

Phase-2 e-invoicing, integration phase, will be implemented from wave 4 for taxpayers exceeding SAR 150M, starting the phase from November 1,2023.

| Integration Wave | Taxpayers with Taxable Revenue Above | Integration Period | Wave's Status |

|---|---|---|---|

| Wave 1 | 3Bn SAR in 2021 | 1 Jan 2023-30 Jun 2023 | Completed |

| Wave 2 | 0.5Bn SAR in 2021 | 1 Jul 2023-31 Dec 2023 | Completed |

| Wave 3 | 250Mn SAR in 2021 or 2022 | 1 Oct 2023-31 Jan 2024 | Completed |

| Wave 4 | 150Mn SAR in 2021 or 2022 | 1 Nov 2023-29 Feb 2024 | About to End |

| Wave 5 | 100Mn SAR in 2021 or 2022 | 1 Dec 2023-31 Mar 2024 | UpComing |

| Wave 6 | 70Mn SAR in 2021 or 2022 | 1 Jan 2024-31 May 2024 | UpComing |

| Wave 7 | 50Mn SAR in 2021 or 2022 | 1 Feb 2024-31 May 2024 | UpComing |

| Wave 8 | 40Mn SAR in 2021 or 2022 | 1 Mar 2024-30 Jun 2024 | Yet to Come |

| Wave 9 | 30Mn SAR in 2021 or 2022 | 1 Jun 2024-30 Sep 2024 |

Yet to Come |

Violation and fines : The Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia has announced on 16th November 2021 the violations and fines related to the first phase of e-invoicing, which started on December 4, 2021. Here's a summary of the key points:

Violation Fines:

-

Not issuing electronic invoices incurs a fine of SR 5,000.

-

Failure to add the QR Code in the simplified tax invoice, the VAT registration number of the purchasing facility in the tax invoice or notify the Authority of any malfunction results in a warning.

-

Deleting or amending electronic invoices after issuance incurs a fine of SR 10,000.

-

Fines are applied based on the type of violation and the number of repetitions.

Compliance Requirements:

-

Taxpayers must stop using handwritten or computer-generated invoices through text editing programs.

-

Ensure a technical solution compatible with e-invoicing requirements is in place.

-

Issue and preserve electronic invoices with all elements, including the QR code for simplified tax invoices and the tax number of the buyer registered in VAT for invoices.

-

Include the invoice address as per the issued type.

Technical Solutions:

-

Taxpayers can choose a technical solution for e-invoicing from a non-binding indicative list of providers posted on the authority's website.

-

The list is not exhaustive, and taxpayers can explore other providers.

Communication Channels:

-

Taxpayers, service providers, and interested parties can reach out for inquiries related to e-invoicing (FATOORA) through various channels:

-

Unified call center number: 19993 (operating 24/7)

-

Twitter account: @zatca_Care

-

Email: info@zatca.gov.sa

-

Live chats on the website: zatca.gov.sa

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.