Revocation of an existing CSID

1. Manual revocation of an existing CSID by the Taxpayer

Taxpayers may wish to revoke their existing CSID(s) for several reasons, including:

- If the Taxpayer believes that the private key or the EGS Unit itself is compromised

- If the EGS Unit is discontinued or transferred to another Taxpayer or sold

- If the Taxpayer discovers that the information in the CSID is not accurate

- If the EGS Unit is lost, stolen or damaged.

- If the Taxpayer discovers that unauthorized onboarding of a EGS Unit has occurred.

The process for Taxpayers revoking one or more CSID(s) is as follows:

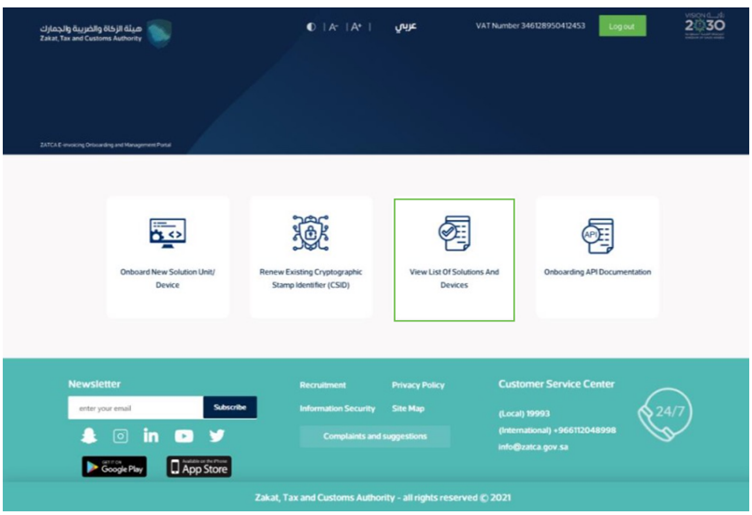

1. The Taxpayer accesses the Fatoora Portal

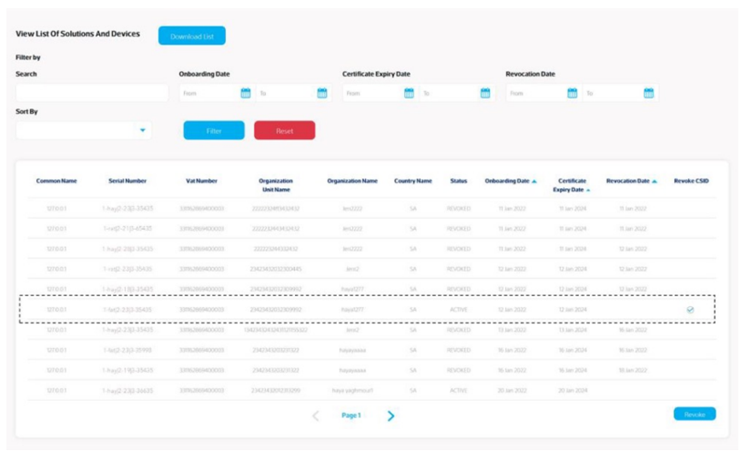

2. The Taxpayer clicks on "View List of Solutions and Devices”.

Fatoora Platform - accessing the list of solution and devices.

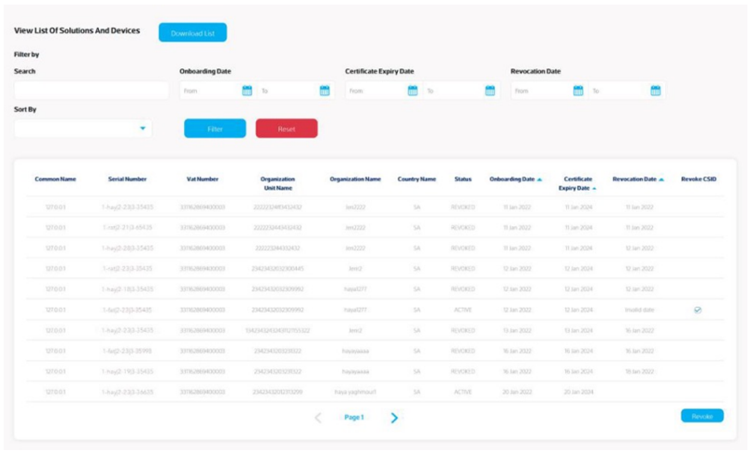

3. The Taxpayer can see which devices are active and can select the EGS unit(s) to be revoked

4. The Taxpayer clicks on the "Revoke" button at the bottom of the screen.

Revocation of an existing CSID

5. The Taxpayer is prompted to click on a confirmation message before proceeding with the revocation.

6. The CSID(s) is/are revoked and the EGS Unit(s) is/are longer active

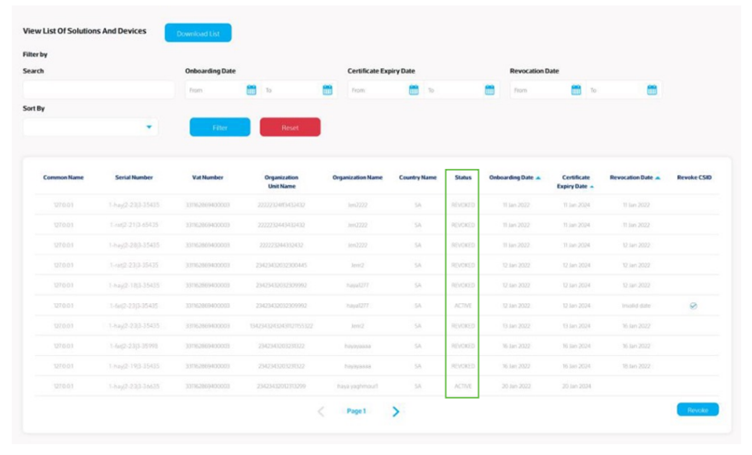

7. The Status of the CSID of the devices can be seen as 'Revoked' on the View List.

2. Automatic revocation of CSID(s) due to VAT Deregistration or Suspension.

The automatic revocation process involves ZATCA CA performing a revocation of CSID(s) associated with Taxpayers whose VAT registration number status (TRN) on the Fatoora Portal (ERAD) changes from "Active" or "Reactive" to "Deregistered" or "Suspended". In this process, ZATCA CA revokes the CSID(s) for Taxpayers with a VAT registration status of "Deregistered" or "Suspended".

For individual VAT Taxpayers, automatic revocation of the CSID(s) would apply in the following case:

- The Taxpayer's VAT registration status on the Fatoora Portal (ERAD) is "Deregistered" or "Suspended".

For VAT groups, automatic revocation of CSID(s) would apply in the following cases:

1. Creating a tax group: ZATCA automatically revokes any existing CSIDs associated with the individual Taxpayers (whether they are the group representative or members) who have joined the tax group (if applicable).

2. Adding one or more members to an existing group: ZATCA automatically revokes any existing CSIDs associated with the individual Taxpayers (group members) who have joined the group (if applicable).

3. Entire group is disbanded: ZATCA automatically revokes any existing CSIDs associated with the group (whether they are for shared devices or devices associated with individual group members).

4. Group representative changes (replaced by existing member or new member): ZATCA automatically revokes any existing CSIDs associated with the group.

(whether they are for shared devices or devices associated with individual group members)

3. Process Flow.

The process for the automatic revocation of a CSID is as follows:

1. Taxpayer's VAT registration status on the Fatoora Portal (ERAD) changes from "Active" or "Reactive" to "Deregistered" or "Suspended”.

2. ZATCA CA revoke the CSID(s) for Taxpayers with a VAT registration status of "Deregistered" or "Suspended”.

3. The CSID status available on the list of devices changes from "Active" to "Revoked”.

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.