- Create Signing Certificates: Sending a Certificate Signing Request (CSR) in order to receive a Compliance CSID

As a part of the first-time onboarding and renewal process, the Taxpayer's EGS Unit(s) must submit a Certificate signing request (CSR) to the E-invoicing Platform once an OTP is entered into the EGS unit.

The CSR is an encoded text that the EGS Unit(s) submits to the E-invoicing Platform and the ZATCA CA to receive a Compliance CSID. This is a self-signed certificate issued by the E-invoicing Platform allowing clients to continue the Onboarding process.

The CSR inputs are as follows:

| Inputs | Business | Desbcription | Specification | Type Of Input |

|---|---|---|---|---|

| Name or Asset Tracking Number | Common Name | Provided by the Taxpayer for each solution unit: Unique Name or Asset Tracking Number of the Solution Unit | Free Text | Manual (Some solutions can have the feature to fill this automatically) |

| EGS Serial Number | EGS | Automatically filled and not by the Taxpayer: Unique identification code for the EGS. | Free Text | Manual (Some solutions can have the feature to fill this automatically) |

| VAT or Group VAT Identifier | Organization | VAT Registration Number of the Taxpayer (Taxpayer /Taxpayer device to provide this to allow to check if the OTP is correctly associated with this TIN) | 15 digits, starting and ending with 3 | Automated (depending on solution) |

| Organization Unit Name | Organization | The branch name for Taxpayers. In case of VAT Groups, the name of the group.this field should contain the 10-digit TIN number of the individual group member whose EGS Unit is being onboarded | If 11th digit of Organization Identifier is "1" is not = 1 then Free text If 11th digit of Organization Identifier = 1 then needs to be a 10-digit number | Automated (depending on solution) |

| Organization Name | Taxpayer Name | Organization/Taxpayer Name | Free Text | Automated (depending on solution) |

| Country Name | Country Name | Name of the country | 2 letter code (ISO 3166 Alpha-2) | Automated (depending on solution) |

| Invoice Type (Functionality Map) | Functionality Map | The document type that the Taxpayer’s solution unit will be issuing/generating. It can be one or a combination of Standard Tax Invoice (T), Simplified Tax Invoice (S), (X), (Y). The input should be using the digits 0 & 1 and mapping those to “TSXY” where: 0 = False/Not supported 1= True/Supported (X) and (Y) are for future use and should be set to 0 by default for the time being. For example: 1000 would mean Solution will be generating Standard Invoices only. 0100 would mean Solution will be generating Simplified invoices (B2C) only and 1100 means Solution will be generating both Standard (B2B) and Simplified invoices (B2C). | Free Text | Manual (Some solutions can have the feature to fill this automatically) |

| Location | Location of Branch or EGS Unit | The address of the Branch or location where the device or solution unit is primarily situated (could be website address for e-commerce). Preferably in the Short Address format of the Saudi National Address https://splonline. com.sa/en/national-address-1/ | Free Text | Automated (depending on solution) |

| Industry | Industry or Location | Industry or sector for which the device or solution will generate invoices | Free Text | Manual |

Note: All CSR fields are mandatory, and the input must follow the specification; otherwise, a CSR could be rejected.

Please refer to the EGS vendor's manual or support for information on how to resolve issues.

- The process for sending a CSR is as follows: Once the OTP(s) has been entered into the Taxpayer's EGS Unit(s), either by the Taxpayer or through the automated process, the CSR process is initiated as per the below steps:

- Create CSR and include the required data.

- Generate public/private key pair.

- Send CSR to generate self-signed certificate.

Possible errors that can occur when submitting a CSR include:

- Invalid OTP/OTC (not exactly six digits, not numeric)

- OTP/OTC not matching for this VAT Registration Number (OTP/OTC provided does not match an active valid OTP/OTC that was generated for this Taxpayer on the portal)

- OTP/OTC expired.

- Invalid VAT Registration Number (Syntax, not corresponding to a valid VAT Registration Number on Fatoora Portal (ERAD).

- Invalid request type.

- Missing fields (with details of the fields missing).

- One or more of the compliance steps has failed.

2.1 Completion of the Compliance checks by the EGS Unit: Once a CSR is sent successfully and the Compliance CSID is obtained, the Taxpayer's EGS Unit(s) must undergo compliance checks to ensure that the EGS Unit is able to generate compliant invoices. Upon successful completion and passing of the compliance checks, the EGS Unit receives a Production CSID. The Production CSID is a certificate issued by the ZATCA CA to enable clients to authenticate and use the core e-invoicing APIs.

- Process Flow: It must be noted that the EGS performs the steps for the completion of the compliance checks automatically. The Taxpayer should refer to the EGS Guideline for the onboarding procedure appropriate to their device.

The process for the completion of the compliance checks is as follows:

1. Formulate a compliant CSR and receive the CSID for onboarding / renewal (checking the capability of the EGS Units to perform renewal). Note that reaching compliance checks implicitly means that the EGS Unit has successfully acquired a compliance CSID.

2. Based on the invoice type that has been added to the CSR, validation checks are required.

a. If the Invoice Type is "1000", then the user should send 3 requests for

I. Standard Tax Invoice (B2B)

ii. Standard Debit Note (B2B)

iii. Standard Credit Note (B2B)

b. If the Invoice Type is "0100", then the user should send 3 requests for

I. Simplified Tax Invoice (B2C)

ii. Simplified Debit Note (B2C)

iii. Simplified Credit Note (B2C)

The compliance verification of an EGS is concluded when the EGS Unit has undergone the compliance checks:

- The submitted documents are checked against all the validations as well as the relevant referential additional checks and all tests are successfully passed.

- Once found to be compliant, the compliance flag is checked.

In the case where one or more tests have failed or are not completed, the Taxpayer's EGS Unit will have to re-initiate the onboarding/renewal process starting from issuing a new OTP and a CSR and undergo the compliance tests again. For further details, please refer to the EGS User Manual.

2.3 Generating a new CSID for the EGS Unit or Renewing the existing CSID: The CSID generation process occurs at the back end of the E-invoicing Generation Solution and is initiated upon the successful completion of the compliance checks and can be regarded as the final step in the journey of receiving a new CSID. The process flow is common for both receiving a CSID for the first time and also for renewing the existing CSID. However, for renewal, the existing CSID of the EGS Unit is revoked and a new one is issued.

2.4 Process Flow:

The process for the generation and renewal of a CSID is as follows:

1. The EGS Unit(s) submit(s) a request to receive its production CSID(s).

2. ZATCA CA issues the CSID(s) for the Taxpayer's EGS Unit(s). In cases of renewal, the ZATCA CA first revokes the existing CSID and then issues the new one.

3. The Fatoora Platform relays the new CSID(s) to the Taxpayer's EGS Unit that originally submitted the CSR to the Fatoora Platform.

2.5 View List of EGS Unit(s):

The Fatoora Portal has a tile that can be accessed from the dashboard, which contains a summary list of the logged-in Taxpayer's onboarded EGS Unit(s).

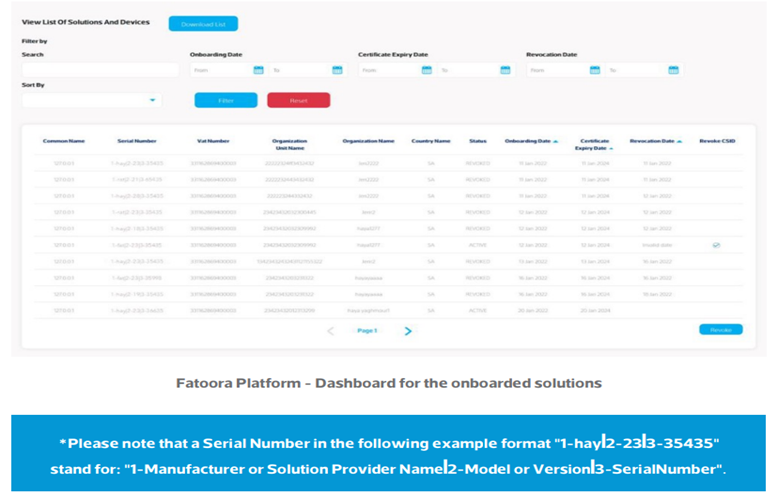

The list includes the following information for each EGS Unit that are provided as part of the CSR:

- Common Name: Name or Asset Tracking Number for the Solution Unit

- EGS Serial Number: Manufacturer or Solution Provider Name, Model or Version and Serial Number

- Organization Identifier: VAT or Group VAT Registration Number

- Organization Unit Name: Organization Unit

- Organization Name: Taxpayer Name

- Country Name

- Invoice Type: Functionality Map

- Location: Location of Branch or Device or Solution Unit

- Industry: Industry or location

In addition, the list also presents the following:

- CSID Status (Active or expired or revoked)

- Onboarding Date

- Certificate Expiry Date

- Revocation Date (if applicable)

- Revoke CSID (checkboxes to be selected)

As an action button:

- Revoke CSID(s) (button appears upon selection of devices to be revoked)

2.6 Process Flow

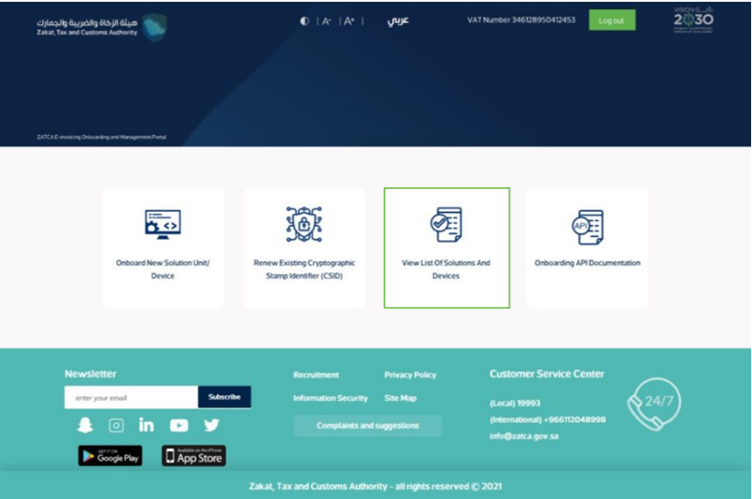

The process for viewing the list of all onboarded EGS Unit(s) on the Fatoora Portal as follows:

1. The Taxpayer accesses the Fatoora Portal

2. The Taxpayer clicks on "View List of Solutions and Devices”.

Fatoora Platform - accessing the list of solution and devices.

3)The Taxpayer will be able to view a list that includes a summary of all EGS Unit(s) that have been onboarded by the Taxpayer, as per the information provided above. The Taxpayer can filter, sort and search based on specific inputs available in the list of Solutions and Devices. (Sorting can take place using the blue arrows next to column headings as shows in the picture below).

Fatoora Platform - accessing the list of solution and devices.

Meet Jadav, an experienced Marketing & Finance professional with a passion for digital transformation. With a background in accounting and technology, He specializes in e-invoicing solutions and writes insightful blogs to educate businesses on the benefits and best practices of adopting electronic invoicing. He is dedicated to simplifying complex financial processes for organizations.

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.