Description of the Onboarding Process

1.1 Taxpayer accessing and logging into the Fatoora Portal using Single Sign On (SSO) using the existing credentials of Fatoora Portal (ERAD):

The Fatoora Portal is the front-end aspect of the Onboarding functionality, and it is regarded as the starting point for Taxpayers to generate CSID(s) for their EGS Unit(s) for the first time, renew their existing CSID(s) and revoke them. Through the Fatoora Portal, Taxpayers can generate One-Time Passwords (OTPs) for the first-time onboarding and the renewal process. Taxpayers can also view a list of all of them onboarded EGS Units along with the status of each unit and revoke existing CSID(s).

- The Onboarding and Management Portal can be accessed, and all of its functionalities can be used by all Taxpayers who are registered on the main Fatoora Portal (ERAD) for VAT purposes and who have a VAT Registration (TRN) status of "Active" or "Reactive".

- Taxpayers who have a TRN status of "Deregistered" or "Suspended" would not be able to access the Onboarding and Management Portal.

- Taxpayers whose VAT registration status used to be "Active" or "Reactive" but changes to "Deregistered" or "Suspended" would be able to access the Onboarding and Management portal for a period of 90 days but can only view a list of their previously onboarded EGS Units and cannot use any other onboarding functionalities such as generating an OTP. Once the buffer period of 90 days is over, these Taxpayers will no longer be able to access the Onboarding and Management Portal.\

1.2 Process Flow

The process of accessing the Onboarding and Management Portal is as follows:

1. The Taxpayer accesses the Onboarding and Management Portal by clicking on the relevant tile on the Fatoora Portal (ERAD).

2. The Taxpayer is redirected to the Fatoora Portal (ERAD) SSO in order to provide their Fatoora Portal (ERAD) credentials and log-in.

3. Upon the successful log-in (authentication) and meeting of the authorization criteria, the Taxpayer is redirected again to the Onboarding and Management Portal landing page.

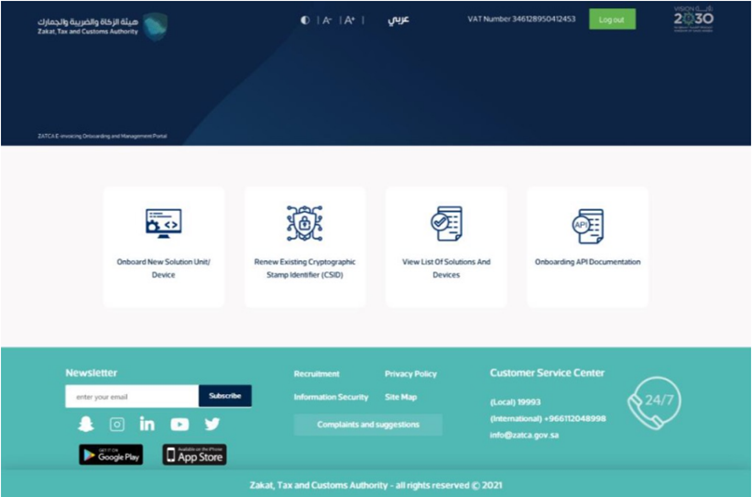

4. On the main landing page, the Taxpayer can see the following tiles:

- Onboard New Solution Unit/Device

- Renew Existing Cryptographic Stamp Identifier (CSID)

- View List of Solutions and Devices

- Onboarding API Documentation

Fatoora Platform Landing Portal

In case the Taxpayer does not meet the defined authentication and authorization criteria for accessing the Onboarding and Management Portal, the Taxpayer will not be able to log in and an error message is displayed indicating that the Taxpayer cannot access the Onboarding and Management Portal.

Note: The Taxpayer can choose to toggle the language between English and Arabic by using the icon on the header of the page.

1.3 Onboarding and Renewal:

Generating an OTP to obtain a CSID for the first time or renewing an existing CSID (Manual OTP entry)

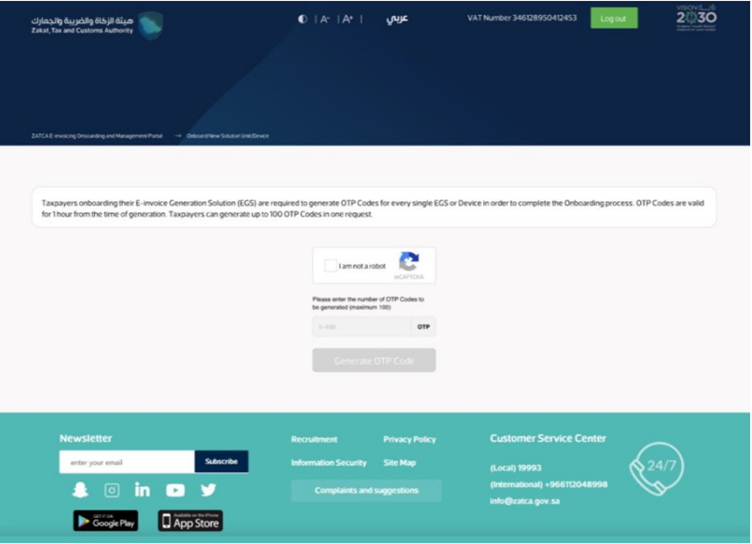

The onboarding and renewal process begins with the Taxpayer accessing the Onboarding and Management Portal to generate an OTP. For a Taxpayer generating an OTP through the Onboarding and Management Portal, there are two options. The first option assumes the manual OTP entry, whereby. Taxpayers can generate up to 100 OTPs in one request, which can then be used to onboard multiple EGS Unit(s) at the same time or renew the existing CSID(s). In the first option, the Taxpayer would need to manually enter the OTP(s) into the EGS Unit(s).

The second option assumes an automatic OTP entry, whereby the Taxpayer can access the Onboarding and Management Portal through their own EGS Unit, and the EGS Unit would then automatically read the OTP code through the header and automatically enter it into the EGS Unit, with no interference from the Taxpayer. The second scenario only allows for onboarding or renewing of the CSID for a single EGS. Unit.

1.4 Process Flow:

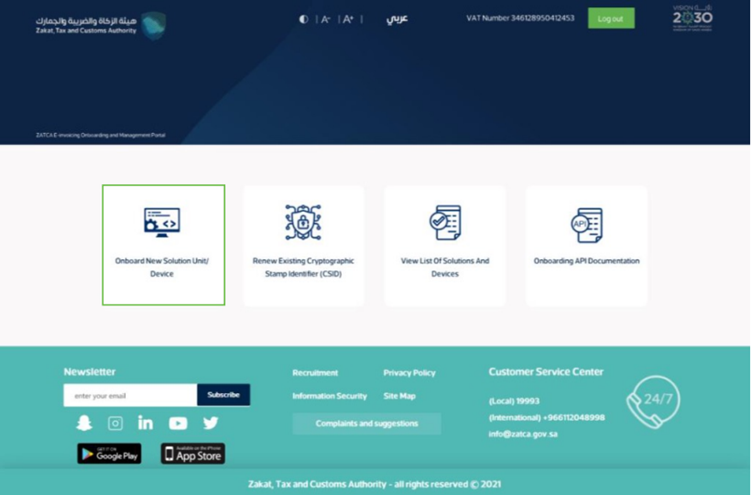

Option 1 - The process for generating the OTP code(s) on the Fatoora Portal and entering them manually is as follows: Fatoora Portal - accessing the “onboard new solution unit/device”.

1. The Taxpayer accesses the Fatoora Portal through a browser (e.g. on a computer) that is not a part of their EGS Unit(s).

2. The Taxpayer clicks on a tile named "Onboard new solution unit/device" and is prompted to click on "Generate OTP code".

Note: Fatoora Portal - accessing the “onboard new solution unit/device”

3. The Taxpayer choses to generate OTP code(s) for single or multiple EGS Unit(s) by entering the number of OTP codes they would like to be generated (User should enter 1 or more (up to 100 per request) based on the number of EGS Unit(s) that they would like to onboard).

Note: Fatoora Portal - specifying the number of OTPs needed by the taxpayer.

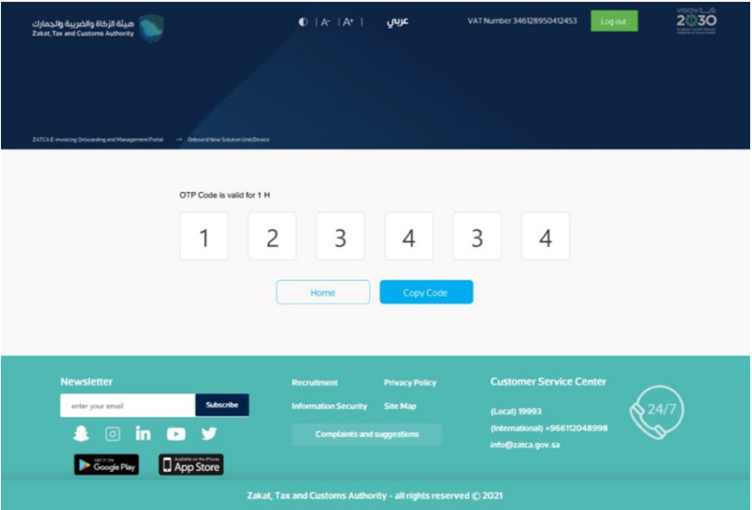

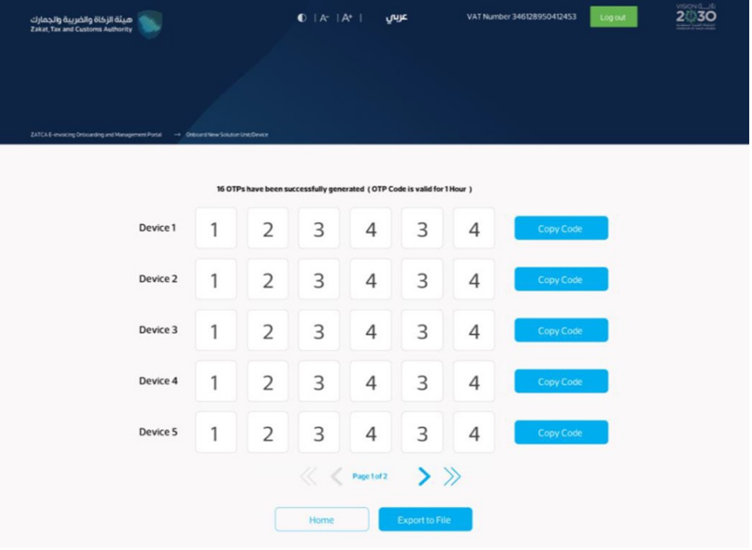

4. The Fatoora Portal generates the OTP code(s) (valid for 1 hour), which will be displayed on the Portal and can be copied or downloaded in a file.

Note: Fatoora Platform - single OTP generated to be entered manually on the EGS.

Note: Fatoora Platform - multiple OTPs generated to be entered manually on the EGS

5. The Taxpayer enters the OTP code(s) on their own EGS Unit(s) within 1 hour of the OTP code's generation.

Option 2 - The process for generating an OTP code on the Fatoora Portal through automatic entry is as follows:

1. The Taxpayer accesses the Fatoora Portal through their own EGS Units

2. The E-invoicing Generation Solution Onboarding and Management Portal automatically generates the OTP code (valid for 1 hour). As the Taxpayer is using their own EGS Unit to access the Onboarding and Management Portal, the OTP code will be automatically entered in the Taxpayers EGS Units

(based on the https header on the browser) without interference from the Taxpayer.

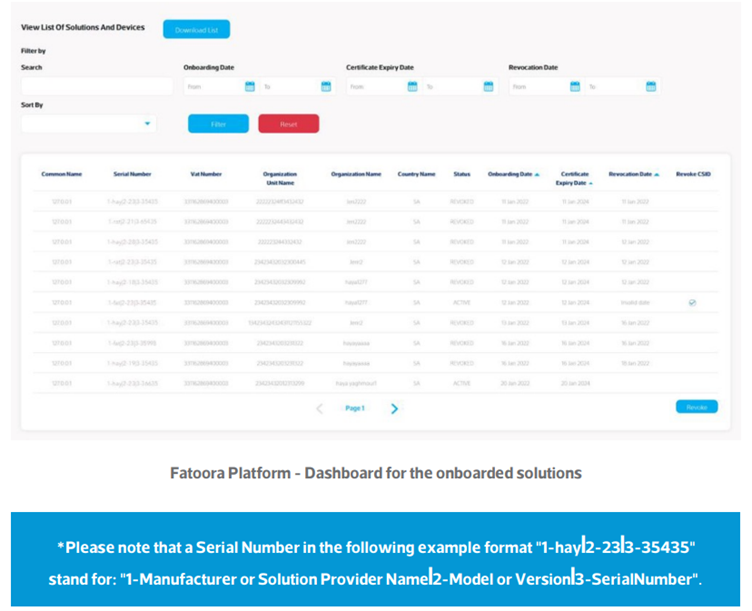

3.The Taxpayer will be able to view a list that includes a summary of all EGS Unit(s) that have been onboarded by the Taxpayer, as per the information provided above. The Taxpayer can filter, sort and search based on specific inputs available in the list of Solutions and Devices. (Sorting can take place using the blue arrows next to column headings as shows in the picture below).

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.