The Onboarding functionality aims to address the following:

- Onboarding of a new EGS Unit(s) (i.e. receiving a CSID for the first-time)

- Renewal of existing CSID(s) for EGS Unit(s)

- Revocation of CSID(s) for one or more EGS Unit(s) (by the Taxpayer or automatically by ZATCA)

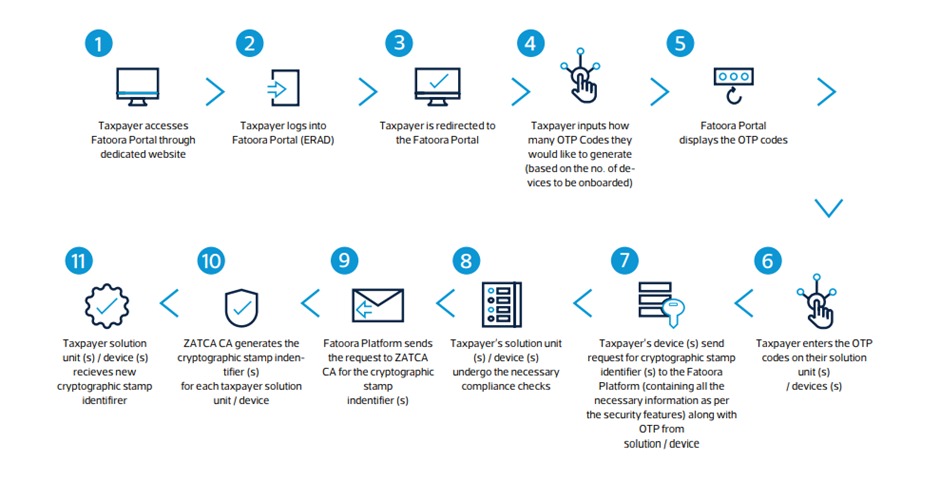

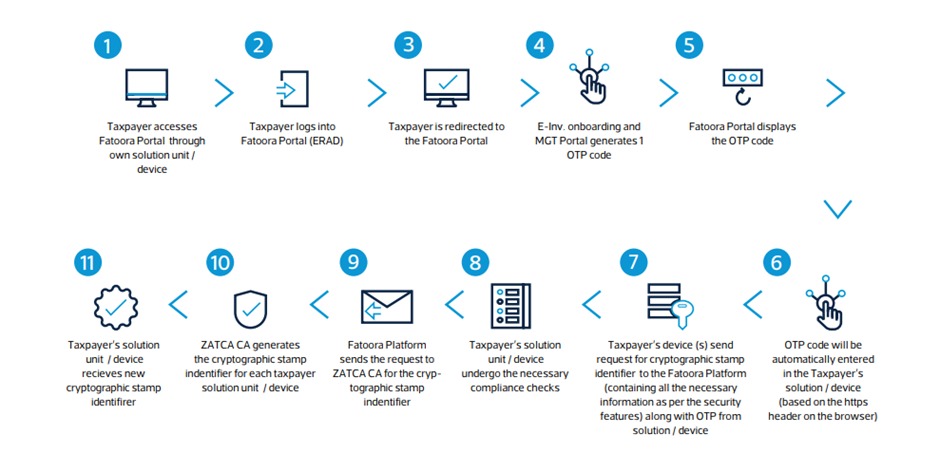

1. Onboarding of a new EGS Unit(s):

The first-time onboarding process requires the generation of a One-Time-Password (OTP) from the Fatoora Portal, which is entered into the Taxpayer's EGS Unit(s) either manually or automatically, followed by the generation of a CSR. The Taxpayer's EGS Unit(s) would then need to undergo the necessary compliance checks. Upon successful completion, ZATCA CA generates the CSID(s) for every EGS Unit(s) which are then sent to the Taxpayer's EGS Unit(s).

There are two methods to generate an OTP. The first method involves the Taxpayer receiving an OTP through the Fatoora Portal, which would be manually entered into the Taxpayer's EGS Unit(s). The second option involves the Taxpayer accessing the Fatoora Portal through their own EGS Units and receiving the OTP, and hence the OTP would be automatically read by their EGS Unit(s). In the first method, it is possible that the Taxpayer would be able to onboard or renew the CSID for single or multiple EGS Unit(s) at the same time, whilst the second option only allows the onboarding or renewing of the CSID for a single EGS Unit.

Diagram 1: Taxpayer receiving a CSID for the first time for one or more EGS Unit(s) - Manual OTP

entry option

Diagram 2: Taxpayer receiving a CSID for the first time for a single EGS Unit - Automatic OTP entry.

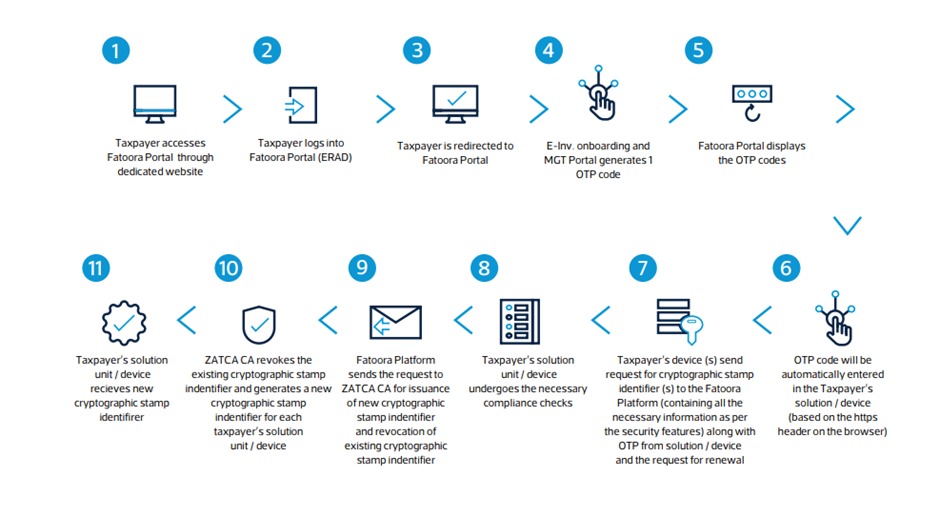

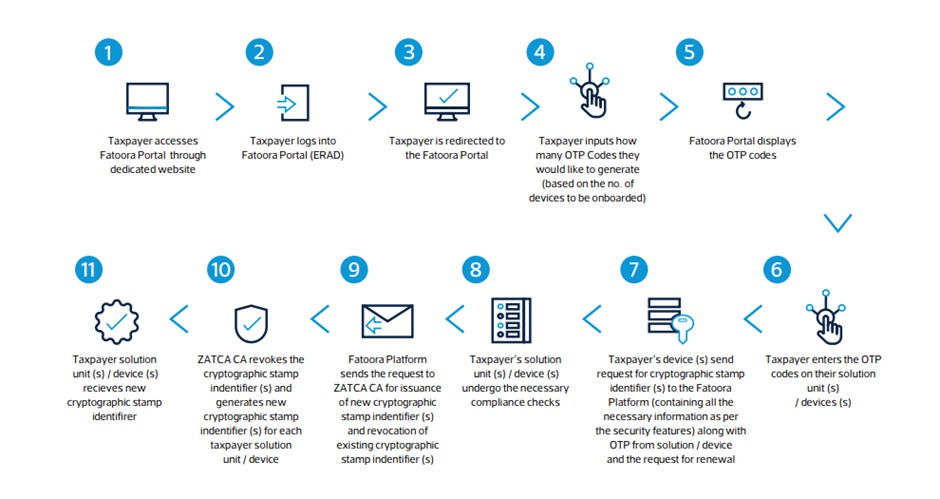

2. Renewal of existing CSID(s) for EGS Unit(s)

The process for the renewal of a CSID is like that of first-time onboarding; however, it involves the revocation of the existing CSID and the issuance of a new one.

Diagram 3: Taxpayer renewing the existing CSID for one or more EGS Unit(s) through manual OTP entry (includes revocation of existing CSID and issuance of a new CSID)

Diagram 4: Taxpayer renewing the existing CSID for one or more EGS Units through automatic OTP entry (includes revocation of existing CSID and issuance of a new CSID)

3. Revocation of CSID(s) for one or more EGS Unit(s) by the Taxpayer

Taxpayers may wish to revoke their existing CSID(s) for several reasons, including:

- If the Taxpayer believes that the private key or the EGS Unit itself is compromised

- If the EGS Unit is discontinued or transferred to another Taxpayer or sold

- If the Taxpayer discovers that the information in the CSID is not accurate

- If the EGS Unit is lost, stolen or damaged.

- If the Taxpayer discovers that unauthorized onboarding of a EGS Unit has occurred

- If there is a major upgrade in the EGS unit.

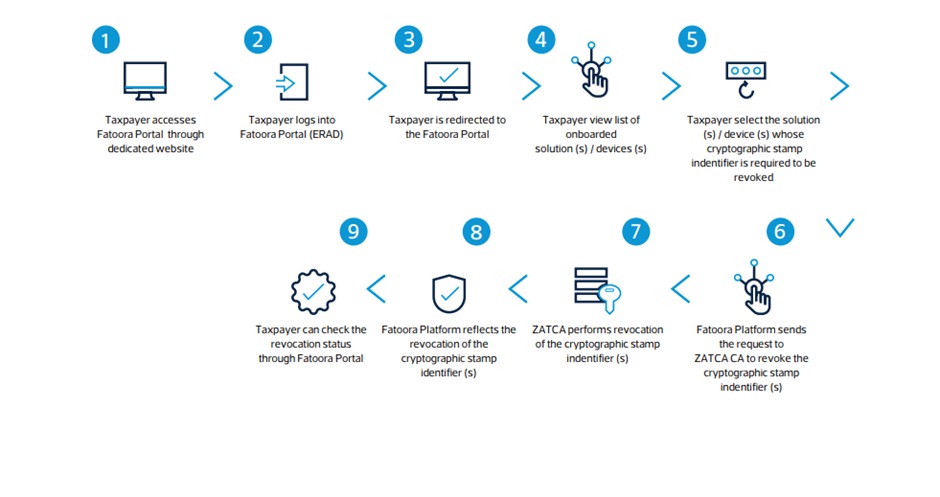

To revoke existing CSID(s), Taxpayers need to access the Onboarding and Management Portal and view a list of all of them onboarded EGS Units(s) and select the ones with active CSID(s) that they would like to revoke.

Diagram 5: Taxpayer revoking the CSID for one or more EGS Unit(s)

Request A Call Back

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.